The Senior Care Policy Briefing covers important long-term care issues by highlighting policy updates, news reports, and academic research.

Read the full Senior Care Policy Briefing below or download here.

April 30, 2024.

NEWSFLASH

- On April 22, 2024, the Centers for Medicare & Medicaid Services (CMS) issued its final nursing home staffing rule. The rule calls for a minimum of 3.48 Hours Per Resident Day (HPRD) of nursing staff time, including at least .55 HPRD for RNs and 2.45 HPRD for CNAs, and requires facilities to have a RN onsite 24 hours per day. While the 24/7 RN requirement is an improvement over current requirements, the overall staffing requirement of 3.48 HPRD is far below the minimum necessary to meet a resident’s clinical needs, no matter treatment with dignity.

- While industry lobbyists have been claiming that any safe staffing requirement will put nursing homes out of business, Morningstar Investor reports that “the biggest stocks in the sector… have been largely unmoved by the announcement.” Morningstar notes that minimum staffing “essentially becomes a nonevent” due to its loopholes and exemption clauses.

- See LTCCC’s brief, The New Federal Nursing Home Staffing Standard: What You Need to Know, for more information on the rule and its strengths and weaknesses.

- A new study reveals that the harm resulting from the use of antipsychotic drugs (APs) in individuals with dementia is even worse than previously acknowledged. The study found that AP use is associated with a heightened risk of various serious adverse outcomes, including stroke, blood clots, heart attack, heart failure, fractures, pneumonia, and acute kidney injury. Despite these safety concerns, APs are still frequently prescribed for behavioral and psychological symptoms of dementia.

LTC BY THE NUMBERS

- Real Estate Investment Trust Welltower’s CEO anticipates “extraordinary growth” for the company in 2024, following a “year of extraordinary achievements” in 2023. Welltower’s same-store revenue growth in the senior housing operating portfolio has been in double digits, with net operating income exceeding 20%.

GET THE FACTS

- Despite industry lobbyists claiming “razor-thin margins,” Skilled Nursing News reports that institutional investors increasingly view nursing homes as a type of infrastructure, resulting in financial gains for the sector. These gains are “also due to a realization among investors that nursing homes are… operationally sound.”

- The National Investment Center for Seniors Housing & Care predicts continued improvement in senior occupancy over the next three years, potentially reaching maximum capacity by 2026.

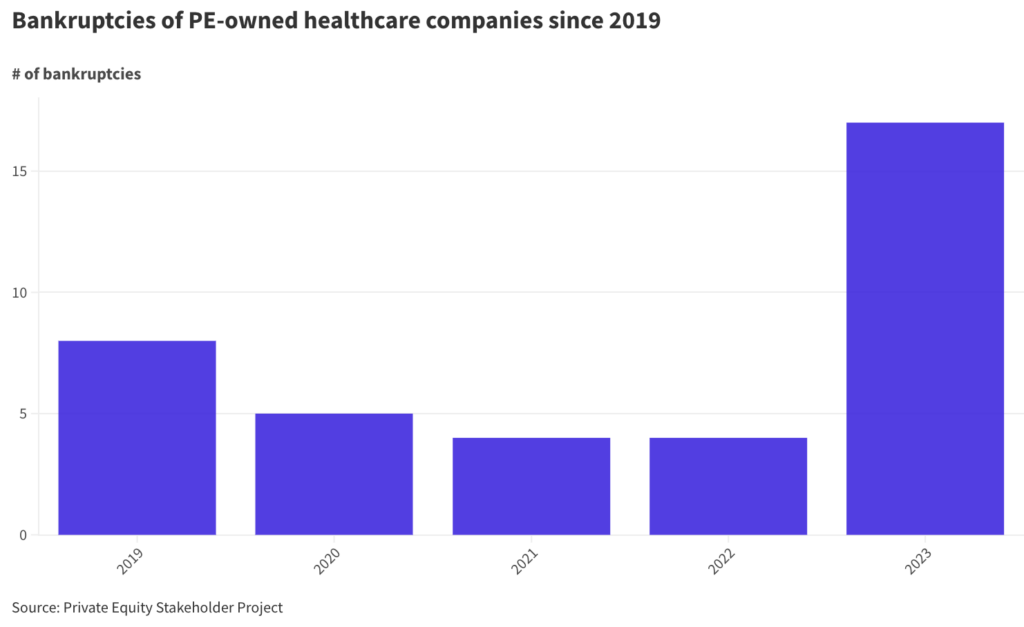

RISE IN BANKRUPTCIES

Private equity healthcare bankruptcies reached a record high last year, as reported by the nonprofit Private Equity Stakeholder Project. The rise in bankruptcies is attributed to private equity’s heavy reliance on debt to fund its healthcare investments. Private equity firms are known to prioritize financial gains over the wellbeing of patients by engaging in cost-cutting measures, including reducing staffing and cutting corners on quality of care.