The Senior Care Policy Briefing covers important long-term care issues by highlighting policy updates, news reports, and academic research.

Read the full Senior Care Policy Briefing below or download here.

November 17, 2025.

NEWSFLASH

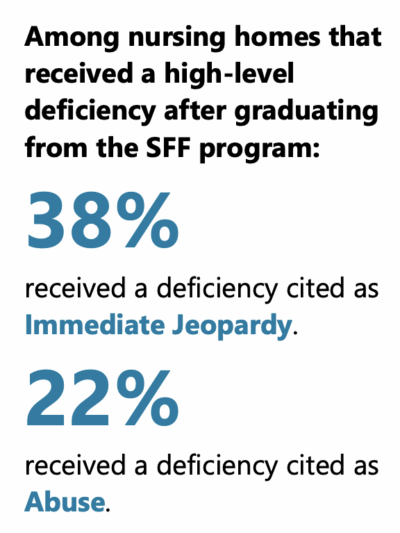

- The Special Focus Facility (SFF) Program, a federal program created to address the nation’s worst nursing homes with persistent failures of care, is falling short of its intended goal of sustained improvement, according to a new analysis by the HHS Office of Inspector General.

- The Program was created to address facilities with “yo-yo compliance,” i.e., a pattern of being cited for failure to comply with minimum standards, ostensibly correcting their deficiencies in order to continue to receive taxpayer funds, only to fall out of compliance again. The basic goal is that a facility either adopts meaningful corrections to its persistent problems or is terminated from federal funding.

- OIG found that, while many facilities enrolled in the program “graduate,” a large share of those graduates quickly revert to serious quality-of-care deficiencies. In fact, nearly two-thirds of homes that exited the program between 2013 and 2022 showed the same kinds of problems that landed them in the program in the first place.

- The current list of SFFs is available here. In addition, LTCCC’s Provider Data Report includes information on whether a facility is a SFF, SFF Candidate, or Problem Facility.

LTC BY THE NUMBERS

- CMS announced a 3.2% increase in Medicare Part A payment rates for nursing facilities beginning in fiscal year 2025, despite MedPAC reporting in June that self-reported profits on Medicare services are over 20%.

- In addition, despite claims of “razor-thin margins,” the senior living and skilled-nursing investment markets are reporting robust growth and strong financial activity:

- The senior living sector posted a 2.88% total return in Q3 of 2025 – highest among all major real-estate property types – and has now out-performed the broader market for three consecutive quarters.

- Welltower Inc. announced $23 billion in transactions, including roughly $14 billion of acquisitions in seniors housing, signaling a significant bet on expansion and investor confidence.

- CareTrust REIT disclosed approximately $437 million in acquisitions of skilled-nursing facilities across multiple states, under triple-net leases and long-term contracts.

- LTC Properties, Inc. completed the sale of five skilled nursing centers for $79 million (expected ~$52 million gain), as part of capital-recycling strategies and portfolio re-balancing.

- American Healthcare REIT, Invesque, National Health Investors (NHI), and Brookdale Senior Living all reported strong third-quarter results, citing robust deal pipelines, rising same-store net operating income, and strategic acquisitions.

Extraordinary Medicare profits, the continued influx of capital, and rising returns raises questions about the efficient and appropriate use of taxpayer funds in the senior care sector. In the absence of meaningful transparency and accountability, there are few barriers to prevent predatory operators from maximizing profits at the expense of resident safety and dignity