The Senior Care Policy Briefing covers important long-term care issues by highlighting policy updates, news reports, and academic research.

Read the full Senior Care Policy Briefing below or download here.

January 15, 2026.

NEWSFLASH

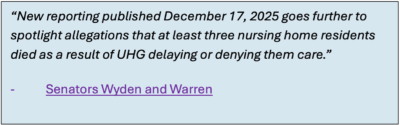

- Senate Finance Committee Ranking Member Ron Wyden and Senator Elizabeth Warren have renewed and intensified their investigation into UnitedHealth Group’s (UHG) nursing home practices following repeated reports that policies tied to its Medicare Advantage and Optum programs may have delayed or denied medically necessary hospital care for nursing home residents, allegedly contributing to deaths. The senators criticized UHG’s prior responses as inadequate and are demanding detailed documentation on hospitalization policies, advance directives, marketing practices, and federal oversight.

- The Centers for Medicare & Medicaid Services (CMS) announced it will remove the count of complaint allegations and facility-reported incidents from the Nursing Home Care Compare public reporting tool beginning February 25, 2026, due to data issues stemming from its transition to a new survey data system and changes in how complaints are defined and handled. CMS says it will continue to display official complaint surveys and citations while it evaluates better ways to present accurate and useful complaint information for consumers.

BOOM TIMES FOR INVESTORS

- The skilled nursing sector is experiencing a surge in mergers and acquisitions, according to McKnight’s, with record-high sale prices signaling strong investor confidence heading into 2026. Improving occupancy, stabilizing reimbursement, and easing credit conditions are driving a seller’s market.

- The Ensign Group, a major skilled nursing provider, announced a quarterly dividend increase to $0.065 per share, reflecting sustained financial performance and confidence in its business model. The move signals continued capital returns to shareholders, underscoring strong investor sentiment in the sector.

- American Healthcare REIT reported $590 million in senior housing transactions this year, highlighting strong investor demand, including properties across independent living, assisted living, and memory care.

While operators routinely argue that they cannot afford to improve staffing or quality, the relentless acquisition of facilities and growing investor returns raise serious questions about where the money paid for nursing home care is actually going.

ROLLBACK RISKS

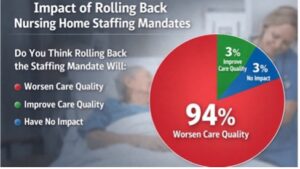

- A recent poll of 262 nurses found that 94% believe rolling back federal nursing home staffing requirements will worsen resident care quality and patient safety, with 84% anticipating increased nursing workload and stress. The vast majority support establishing national minimum staffing standards and prioritize measures such as stronger staffing requirements, better pay and retention, and increased RN presence to improve long-term care quality.